nj property tax relief for veterans

Effective December 4 2020 State law PL. Active Military Service Property Tax Deferment.

New Jersey State Veteran Benefits Military Com

A disabled veteran in New Jersey may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent permanently and totally disabled or the.

. New Jerseys Property Tax Relief Programs. What You Should Know About the NJ Veterans Property Tax Deduction. Property Tax Relief Programs.

We will begin mailing 2021 applications in early. COVID-19 is still active. 2021 Senior Freeze Applications.

250 Veteran Property Tax Deduction. 413 eliminates the wartime service requirement for the 250 Veterans Property Tax Deduction. It was founded in 2000 and has since become a member.

Civil Union Act Implementation. Veterans must have active duty. It was founded in 2000 and is a member of the American Fair Credit.

More veterans can get help with property taxes New Jersey. 100 permanently disabled and unemployable. About the Company Property Tax Relief For Veterans In Nj CuraDebt is a company that provides debt relief from Hollywood Florida.

Voters are being asked whether more vets should be eligible. Applications for the homeowner benefit are not available on this site for printing. Army service members who meet the required criteria have the right to apply for the annual 250 property.

Local Property Tax Relief Programs. The Ocean County Board of Taxation is one of the more advanced assessment systems in the State of New Jersey. 413 eliminates the wartime service requirement for the 100 Totally and Permanently Disabled Veterans Property Tax.

Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their surviving spousecivil uniondomestic partner who are residents of a continuing care. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. Property Tax Relief Forms.

Effective December 4 2020 State law PL. Or blind paraplegic or double amputee due to. Stay up to date on vaccine information.

About the Company Nj Property Tax Relief For Veterans CuraDebt is a debt relief company from Hollywood Florida. 100 Disabled Veteran Property Tax Exemption. Veterans must have active duty.

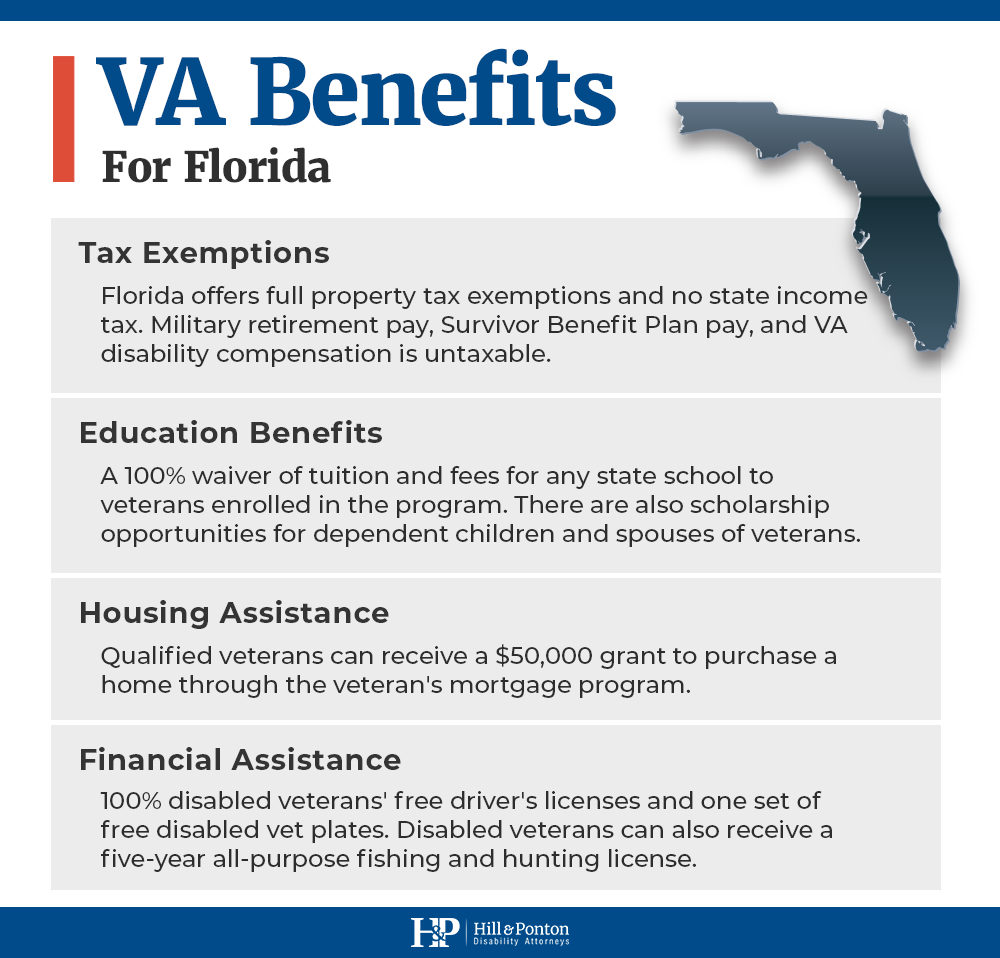

Effective December 4 2020 State law PL. For example veterans with a. 6000 Veteran Income Tax Exemption Military veterans who were honorably discharged or released under honorable circumstances are eligible for a 6000 exemption on.

The 100 property tax exemption for disabled veterans is applicable only to taxes paid on a primary residence. NJs wartime military veterans who own a home can receive a 250 deduction in property taxes. 413 eliminates the wartime service requirement for the 100 Totally and Permanently Disabled Veterans Property Tax Exemption.

413 eliminates the wartime service requirement for the 250 Veterans Property Tax Deduction. Covid19njgov Call NJPIES Call Center for medical information related to COVID. Local Property Tax Forms.

All property tax relief program information provided here is based on current law and is subject to change. 700 to 4000 reduction on property tax bill depending on county of residence. There is no specific property tax break for veterans in New Jersey but they may be eligible for certain exemptions that can lower their overall tax bill.

Effective December 4 2020 State law PL. Board of Commissioners.

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Election 2020 Voters Approve Stronger Veterans Tax Deduction Nj Com

Commissioners Support Legislation To Increase Property Tax Deduction For Veterans

Division Of Veterans Services Cape May County Nj Official Website

N J Challenge To Reduced Property Tax Breaks Under Trump Tax Law Turned Away By Supreme Court Nj Com

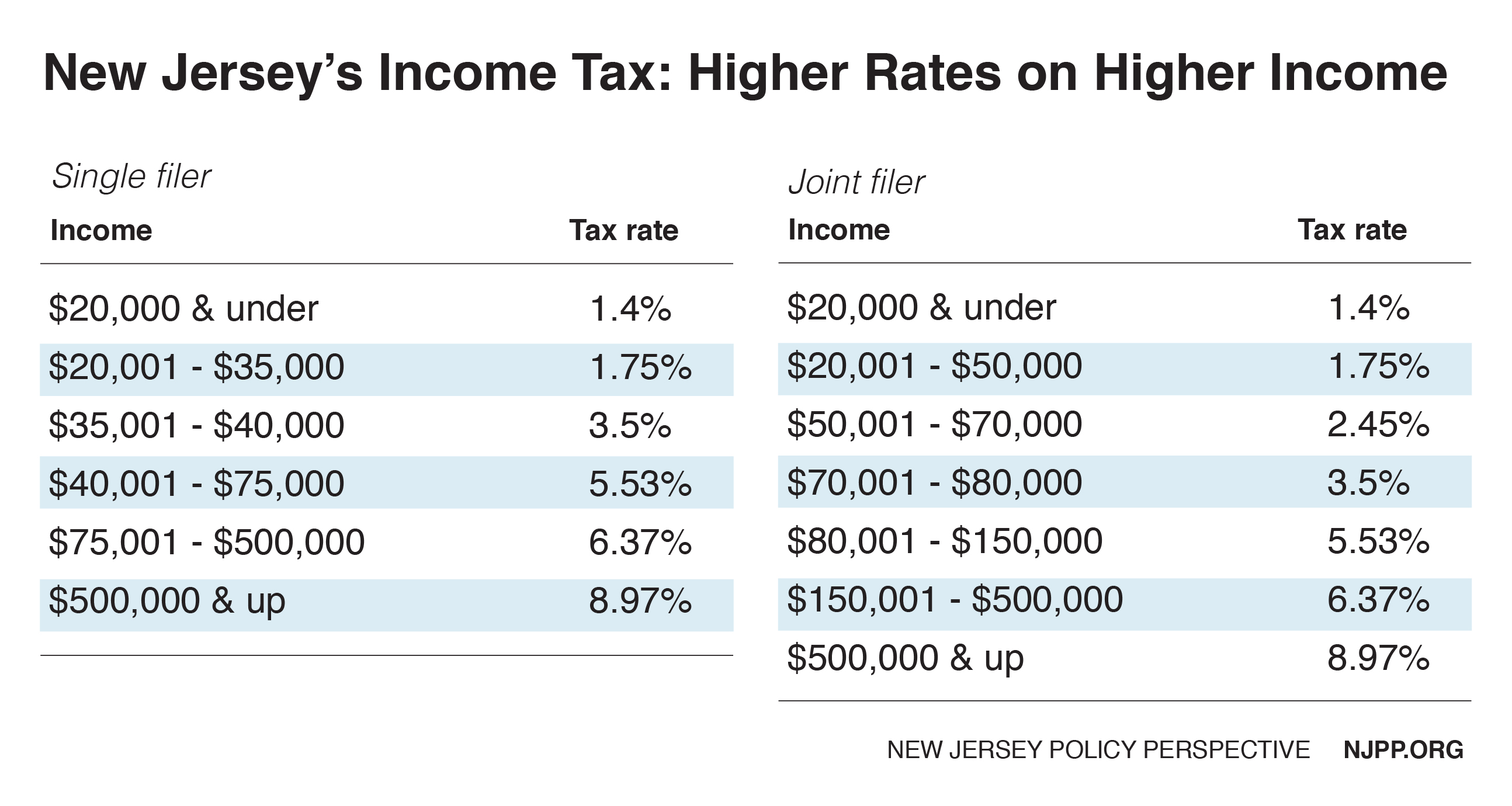

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Tax Break For Disabled Vets Who Own Coops Nj Spotlight News

Veteran Services Passaic County Nj

Nj Voters Expand Property Tax Help For Veterans Here S How To Apply

Tax Assessment And Collection News Announcements West Amwell Nj

Property Tax Calculator Smartasset

Disabled Veterans Property Tax Exemptions By State

Nj Election Voters Will Decide To Expand Veterans Property Tax Deduction

Tax Finance Dept Sparta Township New Jersey

Property Tax Relief Could Be Extended To All Nj Veterans

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download